Caretaker Health Minister Hamad Hasan tried to reassure anxious Lebanese Thursday that the price of hospital fees and medicines would not increase, as the head of the Private Hospitals Syndicate warned that hospitals would soon adjust their pricing of the dollar.

The only obstacle to paying all the insurance claims resulting from the unfortunate 4 August blast at the Beirut port is that there has been no release yet of the report on the investigation into the explosion

Insured losses from the Beirut port warehouse explosion are likely to total around $3 billion, similar to those from an explosion at the Chinese port of Tianjin in 2015, industry sources and analysts say.

The devastating explosion at the Beirut’s port on Tuesday, Aug. 4 caused many casualties and considerable damage, but local insurance penetration rates in Lebanon generally are low, said AM Best in a market commentary.

German reinsurer Hannover Re SE on Wednesday said it will see a “major loss” from the explosion in Beirut, Lebanon, as it reported net income fell 39.3% to €402 million ($478 million) for the first half of the year.

Practically every private household in Lebanon relies on one or other insurance service, beginning with the mandatory protection of motorists under third-party liability insurance or savings schemes offered by life insurers.

Lebanon’s insurance companies will change most of their insurance policies to the current pound price rates in the parallel market as the sector reels under the severe economic conditions

Lebanon’s insurance sector is highly fragmented, featuring extreme competition between small local players, bank-affiliate insurers, providers that are parts of multinational insurance giants, and—outside of the regulated sphere of commercial insurance companies

In the immediacy of the coronavirus crisis, the most pertinent insurance question for the holder of a medical policy is simple: Who will pay if I need to be hospitalized?

Lebanese Minister of Economy, Mr Raoul Nehme, called on insurance companies to cover COVID-19 in their insurance plans, stressing the need for “all parties to play their part in providing appropriate support

All the insurance companies in the country will fully cover policyholders that are being treated for coronavirus infection, said Elie Torbey Chairman of the Association of Insurance Companies (ACAL).

COVID-19, the disease caused by the 2019 Novel Coronavirus is a known and rapidly evolving epidemic that is affecting travel worldwide, with continued spread and impacts expected.

Lebanon has a long history of economic and political instability. In the past, local insurers have been successful at navigating this challenging environment.

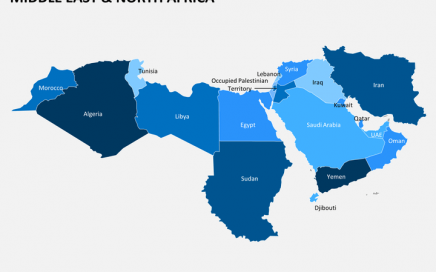

The General Arab Insurance Federation (GAIF) is working on improving technical standards among its members, according to Mr Chakib Abouzaid, the secretary general of the organisation.

According to the 2019 emerging risks barometer, established by the French Federation of Insurance, cyber risk appears to be a major risk for insurance and reinsurance companies.

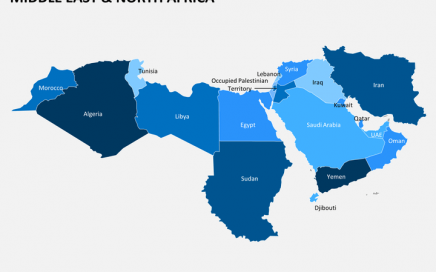

The insurance written premiums in the Middle East and North Africa (MENA) reached 56.965 billion USD in 2018 against 58.936 billion USD in 2017, thus decreasing by 3.5%. Global premiums, however, rose by 4.8%.